It’s been a week of mind-boggling numbers in the news: whether you look at the work of professionals working the crypto market or the impact of traditional and not so traditional financial instruments. This and some more in the latest FinTechnologist Weekly:

Whales and Rule-Makers

Why Crypto (Still) Has A Bad Reputation

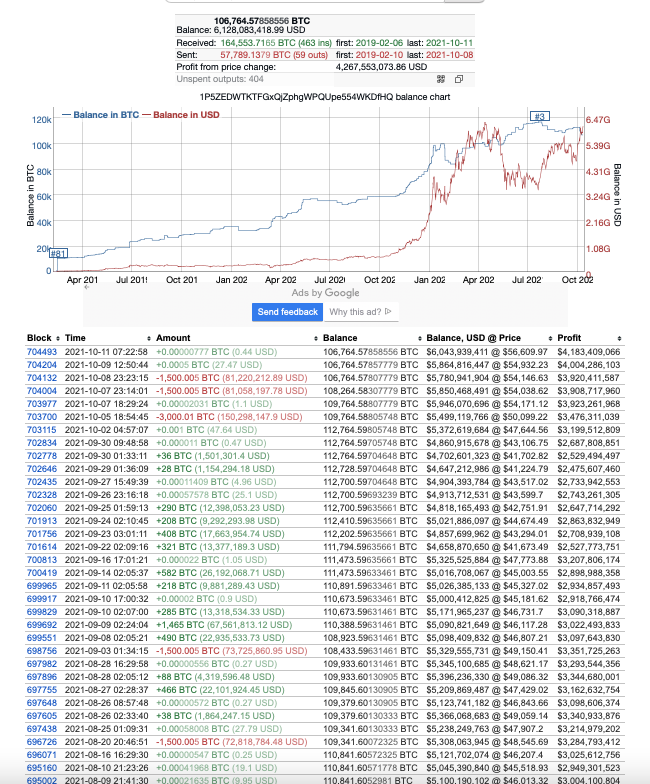

Last week, we discussed the BTC ownership of China that stems from the requisition of funds from a Ponzi scheme. I also mentioned that from an investment perspective it wouldn’t make sense to dispose of these coins quickly as it could have a market impact. Funnily, I read a tweet about the third largest Bitcoin whale wallet selling 3,000 BTC at roughly $50k. The tweet went on the say that whoever was behind the address had realized a profit of $15 million within a month of trading. Not bad. The first question you’ll probably ask yourself is whether that person actually pays capital gains tax on that money. Unlikely, I’d say, but who knows, maybe the local tax authorities are closely monitoring an account that at its peak held 116,840 odd bitcoins though that’s down to a mere 106,764 BTC today. Still, at current value it’s worth almost $6 billion.

Last week, we determined that China at one point held 194,000 BTC (and might still so), but thought that the Chinese government might be less interested in its impact on market movements when deciding what to do about their stock (still, they won’t drop it in one go even if they were to dispose of it, I’d assume). The dealings of the Bitcoin investor above, however, are almost certainly driven by market considerations and while it is almost a small percentage of the total circulating supply of bitcoins, any large movement could have a price moving impact. Even if you sell a small amount (of sorts) like the 3,000 BTC sold the other day, drawing $150,000,000 out of the market doesn’t go unnoticed. Or shouldn’t. And that’s probably the question. While a number of providers offer solutions that help authorities trying to keep track of the flow of funds across cryptocurrencies, it is doubtful they can track and stay on top of everything. Without making any accusations and simply using this specific account as an example, we could have a look at a number of recent sell orders for exactly 1,500 BTC as opposed to the slow build-up in smaller amounts. Probably, the ordinary work of a good trader (based on the profits realized), it shows though the difficulty for regulators and the risk inherent in crypto markets. After all, this is a rather prominent example of a crypto wallet that would receive significantly more attention than the many smaller ones that operate out there for questionable purposes. No wonder then that there is a lot of talk about money laundering and market abuse in cryptocurrency markets, you see?

The Systemic Risk of ETPs

A number of US regulators have warned that leveraged ETPs pose systemic risk to markets and are calling for stricter rules that apply to these complex vehicles.

SEC chairman Gary Gensler stated that he supported the introduction of new rules following a warning from US regulatory agencies dating back more than a decade about the risks to retail investors posed by leveraged ETP. The call for more regulation was supported by two SEC commissioners, Alison Helen Lee and Caroline Clenshaw, who issued a joint statement to reinstate plans to force brokers and investment advisers to check to ensure that clients properly understand the risks before allowing retail investors to buy and sell leveraged ETPs.

Just to give you an idea as to the numbers we are talking about, the to London-based consultancy ETFGI estimates that from the end of 2017 global assets held in Leverage and Inverse ETP increased from $ 80.8 billion by more than 50% to $ 112 billion at the end of August. ETPs have across the board seen a strong rise in numbers and only recently cryptocurrency ETFs have received some bad press, but it is the element of leverage that is rather concerning as leveraged ETFs could have a volatile impact on financial markets, especially during times of stress when asset prices are falling sharply.

Regulators under Fire

Talking about Gary Gensler, he’s been the subject of some criticism courtesy of Tom Emmer, a representative from Minnesota and co-chair of a group of lawmakers interested in blockchain. He said that Gensler was overstepping his authority with his attempts to expand the SEC’s role in regulating cryptocurrencies and put several regulatory proposals into question. Gensler had told Congress on Tuesday that he wanted crypto platforms to be registered with the SEC, adding: “Right now [investors] don’t have the benefit of that basic bargain that we protect people against fraud and manipulation . . . People are going to get hurt.”, the FT writes.

A number of senior politicians as well as lobbyists (which could be intrinsically connected if I come to think about it) have pushed back over the past weeks, but the both threats – to innovation on one hand and investors on the other – are real, so regulators need to tread carefully to strike the right balance. At least they seem to have a conversation though, which is much more than you could say only a few years ago…

—

Well, that’s all for this week but if you have an interesting story, please connect on Twitter. And if you would like to join me on the new FinTechnologist podcast, the same applies, of course. So, make sure you get in touch and in the meantime, have a good week!

——–

Disclaimer: As always, I’m trying to be completely transparent about affiliations, conflicts of interest, my expressed views and liability: Like anywhere else on this website, the views and opinions expressed are solely those of the authors and other contributors. The material information contained on this website is for general information purposes only. I endeavor to keep this information correct and up-to-date, I do not accept any liability for any falls in accurate or incomplete information or damages arising from technical issues as well as damages arising from clicking on or relying on third-party links. I am not responsible for outside links and information is contained in this article nor does it contain any referrals or affiliations with any of the producers or companies mentioned. As I said, the opinions my own, no liability, just thought it would be important to make this clear. Thanks!